Constellation

Energy (CEG) Shows Bullish Momentum Amid Market Confidence

Constellation Energy Corp (NYSE: CEG) experienced a notable upswing today, with its stock climbing to $296.15—an increase of $4.68. This movement signifies growing investor confidence and strong interest in the company’s strategic trajectory.

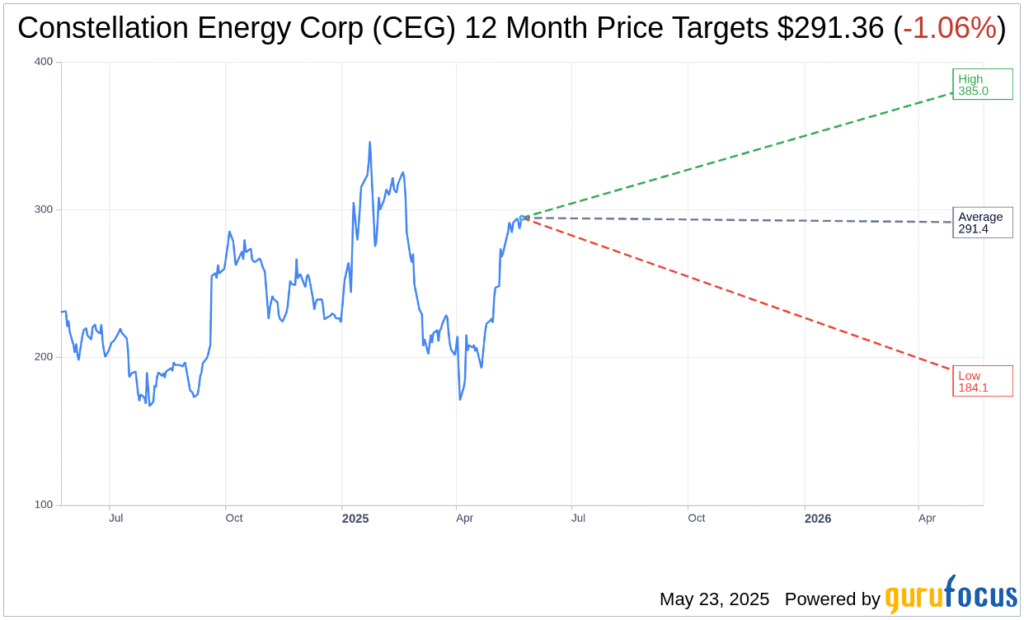

Analyst Price Targets Reveal Cautious Optimism

Thirteen financial analysts have weighed in on Constellation Energy’s one-year price outlook. They forecast an average target price of $291.36, with a range between a low of $184.05 and a high of $385.00. Based on the current price of $294.48, this implies a potential downside of 1.06%. For detailed data, refer to the full forecast section of the Constellation Energy Corp profile.

Wall Street’s Recommendation: Outperform

The consensus from 17 major brokerage firms rates CEG at an average score of 1.9, positioning the stock within the “Outperform” category. This scale ranges from 1 (strong buy) to 5 (sell), signaling that the company is expected to exceed average market performance.

GuruFocus Value Suggests Overvaluation

According to GuruFocus, the GF Value—a fair value estimation based on historical valuation metrics and projected business growth—pegs CEG’s one-year fair price at $106.44. This represents a potential decline of 63.85% from its present market value, suggesting it may currently be overvalued. For more insights, visit the GF Value section of the Constellation Energy profile.

Constellation Energy: Major Q1 2025 Highlights

Release Date: May 6, 2025

- GAAP Earnings: $0.38 per share

- Adjusted Operating Earnings: $2.14 per share—$0.32 higher YoY

- Annual EPS Outlook: Reaffirmed at $8.90 to $9.60

- Nuclear Generation: Surpassed 41 million MWh, with a 94.1% capacity factor

- Refueling Outage Performance: Average 24 days, outperforming industry norms

- Renewable Energy Capture: 96.2%

- Power Dispatch Match: 99.2% efficiency

- Calpine Acquisition: Expected to boost EPS by $2 and add $2 billion in FCF starting next year

- Inflation Adjustment Impact: Anticipated $500 million revenue boost by 2028

- Buyback Authorization: ~$1 billion in shares authorized for repurchase

For complete earnings call insights, refer to the official transcript on the company’s investor relations page.

Positive Catalysts Fueling Growth

- Earnings Outperformance

CEG delivered solid Q1 results with GAAP earnings at $0.38 and adjusted operating earnings at $2.14 per share—an increase from the previous year. - Data Economy Strategy

The company is actively pursuing opportunities in the data economy, backed by rising demand for clean, uninterrupted energy sources. - Nuclear Energy Leverage

Constellation’s reliable nuclear assets position it to meet surging energy demands, especially from data centers and AI infrastructure. - Strategic Calpine Acquisition

The addition of Calpine strengthens Constellation’s competitive edge, enhancing operational capabilities and revenue generation. - Strong Credit Rating

A solid investment-grade rating bolsters customer trust and facilitates long-term contract negotiations.

Risks and Challenges Ahead

- Market Volatility

Despite strong performance, CEG remains susceptible to macroeconomic factors that can trigger short-term price swings. - Regulatory Hurdles

Delays at FERC in approving behind-the-meter energy configurations could hinder growth in this segment. - Rising Power Generation Costs

The increasing cost of combined-cycle plants and solar-plus-storage solutions poses a risk to profitability and expansion plans. - Data Center Demand Concerns

Some industry voices question the sustainability of current data center demand forecasts, potentially leading to overcapacity. - Policy Uncertainty

The reconciliation of the Inflation Reduction Act and nuclear energy tax credits may bring unforeseen complications to financial planning.

Disclosure

Statement:

The author(s) may hold positions in the securities mentioned, but these do not represent a material interest or influence over this analysis.